Alliant's 2019 Rate Case: Time to Kick Expensive Coal

posted

by Nathaniel Baer on Thursday, August 8, 2019

Alliant Energy recently requested a 24% rate increase on residential customers from the Iowa Utilities Board – about $240 per year for the average household. First, Alliant has to go through a contested case process with written testimony submitted by interested parties. The Iowa Environmental Council and Environmental Law & Policy Center (ELPC) filed testimony from five expert witnesses last week identifying a wide range of significant concerns with Alliant’s proposal.

One of our biggest findings: coal no longer makes economic sense in Iowa.

Coal Plants in Iowa

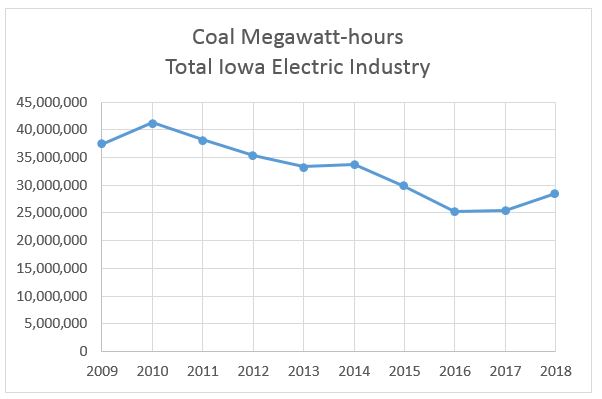

Alliant Energy and MidAmerican Energy own and operate nine coal plants in Iowa that add up to 5,003 megawatts (MW) of total capacity. Despite Iowa’s wind energy leadership, coal is still the largest source of electricity generation. The Alliant and MidAmerican coal plants account for most of the coal in Iowa. After years of declining carbon pollution from these plants, coal use has increased recently bringing with it higher emissions.

Iowa Coal Plant Generation 2009-2018

Source: EIA, State Electric Profiles: Iowa (Table 5); Electric Power Monthly (Feb. 2019).

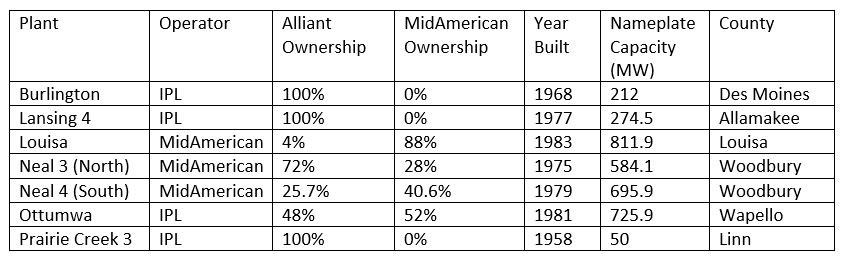

Alliant wholly owns three coal plants in Iowa and has an ownership interest in several others, totaling seven coal plants in all. These plants were mostly built in the 1960s and 1970s. They are outdated, polluting, and IEC’s analysis shows the time has come to stop using them.

Alliant Coal Plants – Plants Owned or Co-Owned by Alliant

Source: EIA Form 923 (2017), Form 860 (2017).

Expert Analysis and Findings

Coal plants are a drain on Iowa’s environment, polluting our air and water. New testimony filed with the Iowa Utilities Board shows that coal plants are also a drain on Iowa’s economy and customer wallets.

One key concern is that Alliant’s coal plants are more expensive than readily-available alternatives, including wind, solar, and power from the regional wholesale market. By running these coal plants, Alliant’s consumers will pay more over time than if Alliant developed a plan to retire the plants and replace them with a mix of clean energy resources. Retiring coal plants is an important strategy for managing Alliant’s high and increasing rates. [NB1]

IEC and ELPC contracted expert witness Uday Varadarajan to analyze the economics of these coal plants, as well as several Alliant natural gas plants, using publicly-available data from the Energy Information Administration (EIA) and the Federal Energy Regulatory Commission (FERC). His testimony examines the fuel and other operating costs for each coal plant along with capital costs and other costs at each plant.

Varadarajan also examines data on the costs of alternatives. This included the cost of energy (kilowatt hours used), capacity (amount of energy that can be produced), and other services in the regional market operated by the Midcontinent Independent System Operator (MISO) and the cost of new renewable energy, particularly wind.

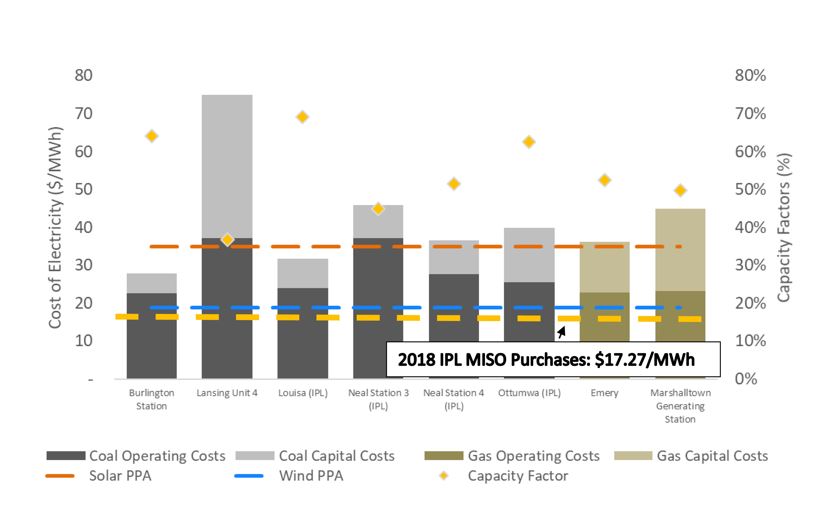

Summary of cost analysis of Alliant coal and gas plants compared to renewable and market prices

Source: Varadarajan direct testimony, p. 10, citing IPL FERC Form 1, EIA 923, and DOE 2017 Wind Technologies Market Report. Note - the analysis focused on six of the seven coal plants that Alliant owns or co-owns as well as two large gas plants that Alliant owns.

This chart compares the cost of electricity from Alliant’s coal and gas plants to the cost of electricity from wind, solar, and the regional MISO market. The operating cost alone of every coal and gas plant is above the cost of both wind and market power today. The total cost of all plants is well in excess of wind and market prices and many are also above the cost of solar today. Solar costs are likely to continue declining, making solar resources an even better investment in the near future.

Varadarajan’s analysis accounts for the unrecovered balance at each plant, or how much capital cost remains for Alliant to charge to consumers. This information helps to identify a plan to retire the units in a way that maximizes benefits for consumers as well as Alliant and its investors.

Varadarajan recommends retiring Burlington and Alliant’s share of Neal 3 and Neal 4 immediately, which would save Alliant consumers $16 million in the first year of retirement. These plants have lower remaining plant balances and, like all of Alliant’s coal plants, are more expensive than clean energy or buying power from the wholesale market.

Varadarajan indicates that consumers would save money immediately by retiring these plants, replacing fossil fuel power with wind, and allowing Alliant to recover the remaining capital costs over the next decade (known as accelerated cost recovery).

For several other coal plants, including Ottumwa and Lansing, Varadarajan suggests examining and using a range of tools to improve the outcomes for consumers from the retirements. An ideal tool is ratepayer-backed bond securitization. This involves issuing low-interest bonds to cover the cost of retirement, which provides savings over the much higher-interest financing that utilities typically use.

However, securitization requires state enabling legislation, which the Iowa legislature has not passed. If the Iowa Utilities Board initiated a plan to retire these units, it could set up securitization at a future date once the Iowa legislature acts. Alternatively, additional tools are also available to reduce costs and risks for consumers that do not require additional legislation. The key step is to commit now to retire these plants and do so as rapidly as possible, rather than continue to operate them or even to invest more capital in coal plant maintenance and upgrades.

Iowa’s uneconomic coal plants are part of a trend across the United States. For example, a recent analysis by Energy Innovation and Vibrant Clean Energy found that 74% of U.S. coal plants are more expensive today than newly built local wind and solar. By 2025 – less than six years from now – nearly all coal plants will be more expensive than local renewable energy. This cost-saving analysis is another compelling reason to accelerate the transition to 100% renewable energy. We hope the Iowa Utilities Board and Alliant commit to a plan to retire Alliant’s coal plants as quickly and beneficially as possible for Iowa consumers.

- carbon pollution

- clean energy

- solar power

- wind power